Information of cross-border

M&A market

Information of cross-border

M&A market

-

Jan.16.2026

Updated the M&A market information of 2025

-

Oct.21.2025

Updated "2. M&A transactions in the major 6 countries in the ASEAN”.

-

July.16.2025

Updated "2. M&A transactions in the major 6 countries in the ASEAN”.

-

Apr.14.2025

Updated "2. M&A transactions in the major 6 countries in the ASEAN”.

-

Jan.23.2025

Updated the M&A market information of 2024

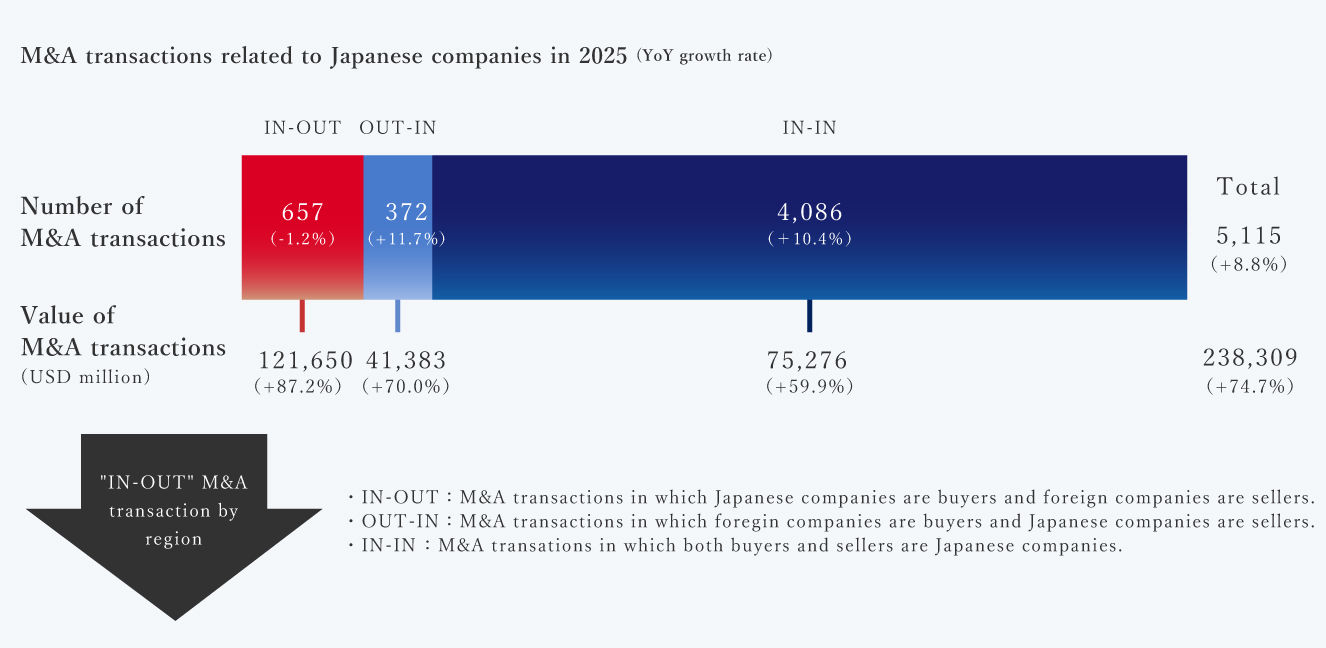

The total number of M&A deals in 2025 was 5,115, a increase of 8.8% compared to the previous year.By market, OUT-IN and IN-IN increased, while IN-OUT decreased. The overall value of M&A increased by 74.7% compared to the previous year, due in part to an increase in large-scale deals. There was an increase in all three markets: OUT-IN , IN-IN and IN-OUT.

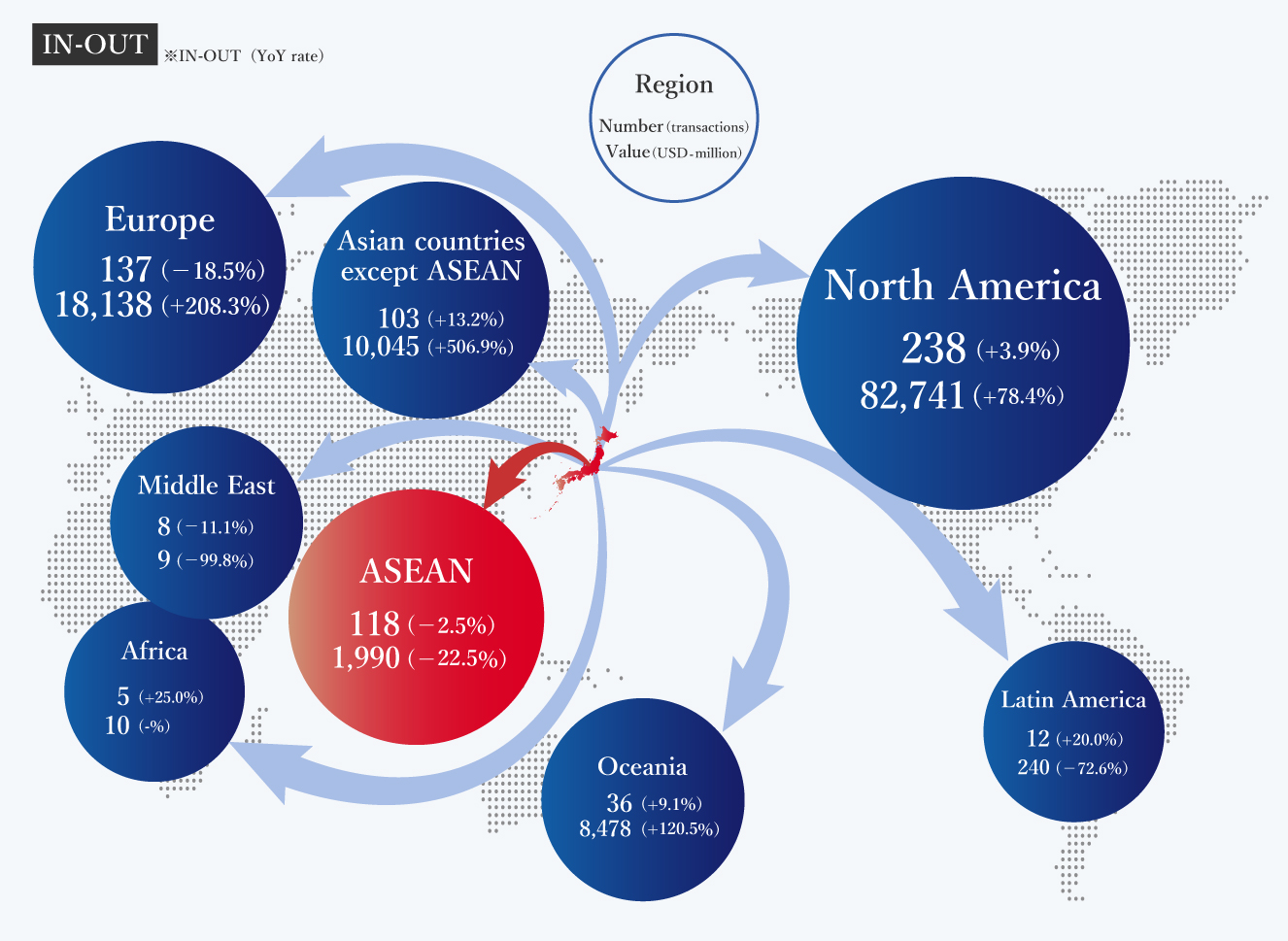

The number of "IN-OUT" M&A transactions between Japan and the ASEAN was high and next to the numbers between Japan / North America and Japan / Europe.

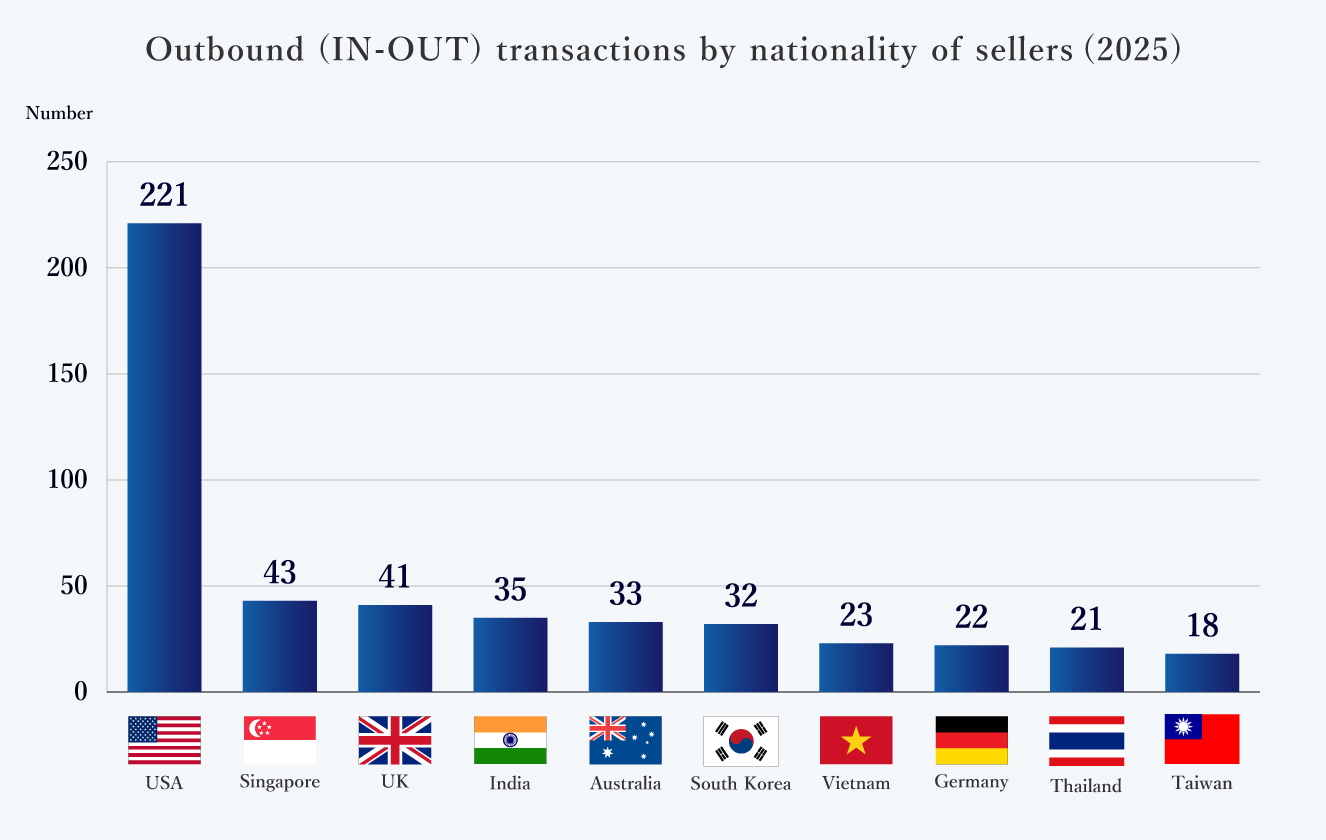

The United States has the largest share in IN-OUT transactions from Japan. Among ASEAN countries, Singapore is the most, followed by Vietnam.

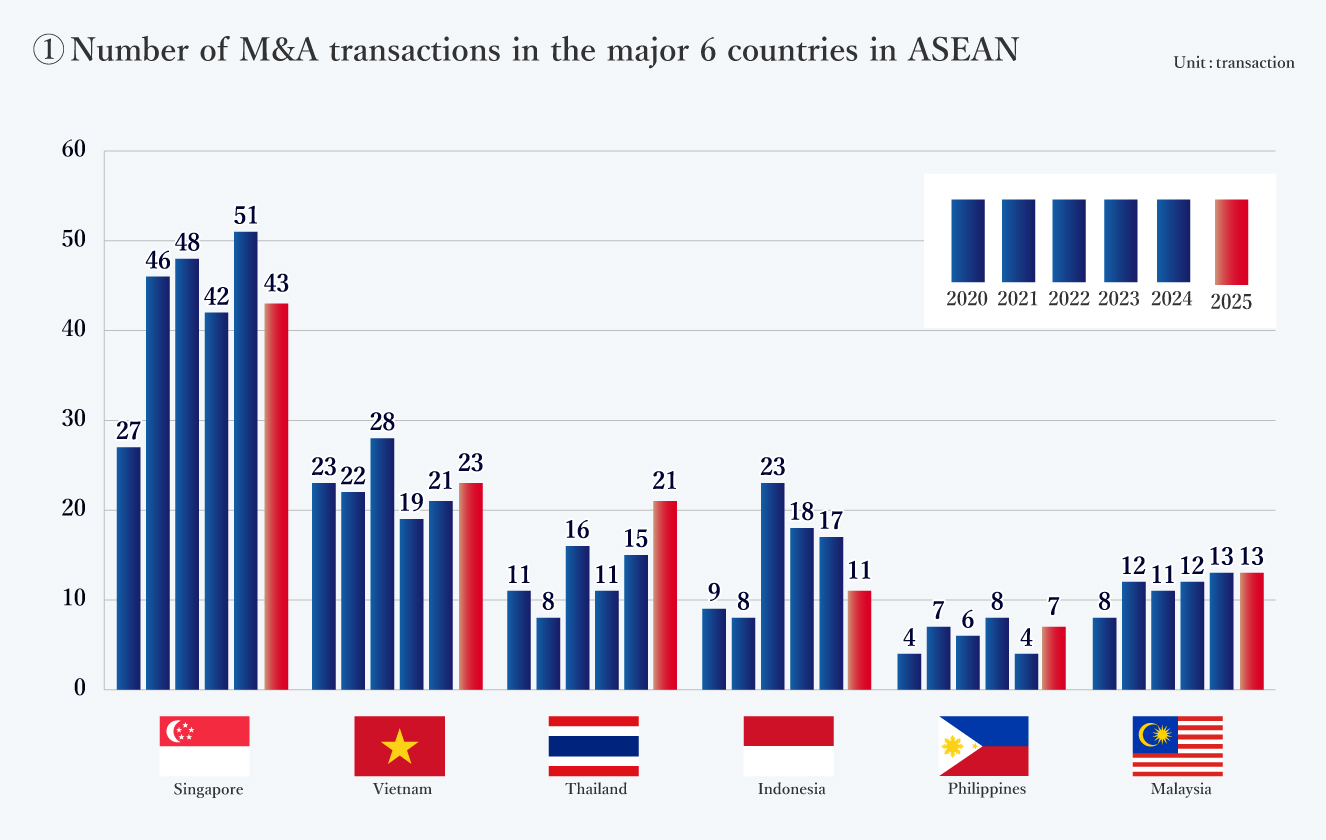

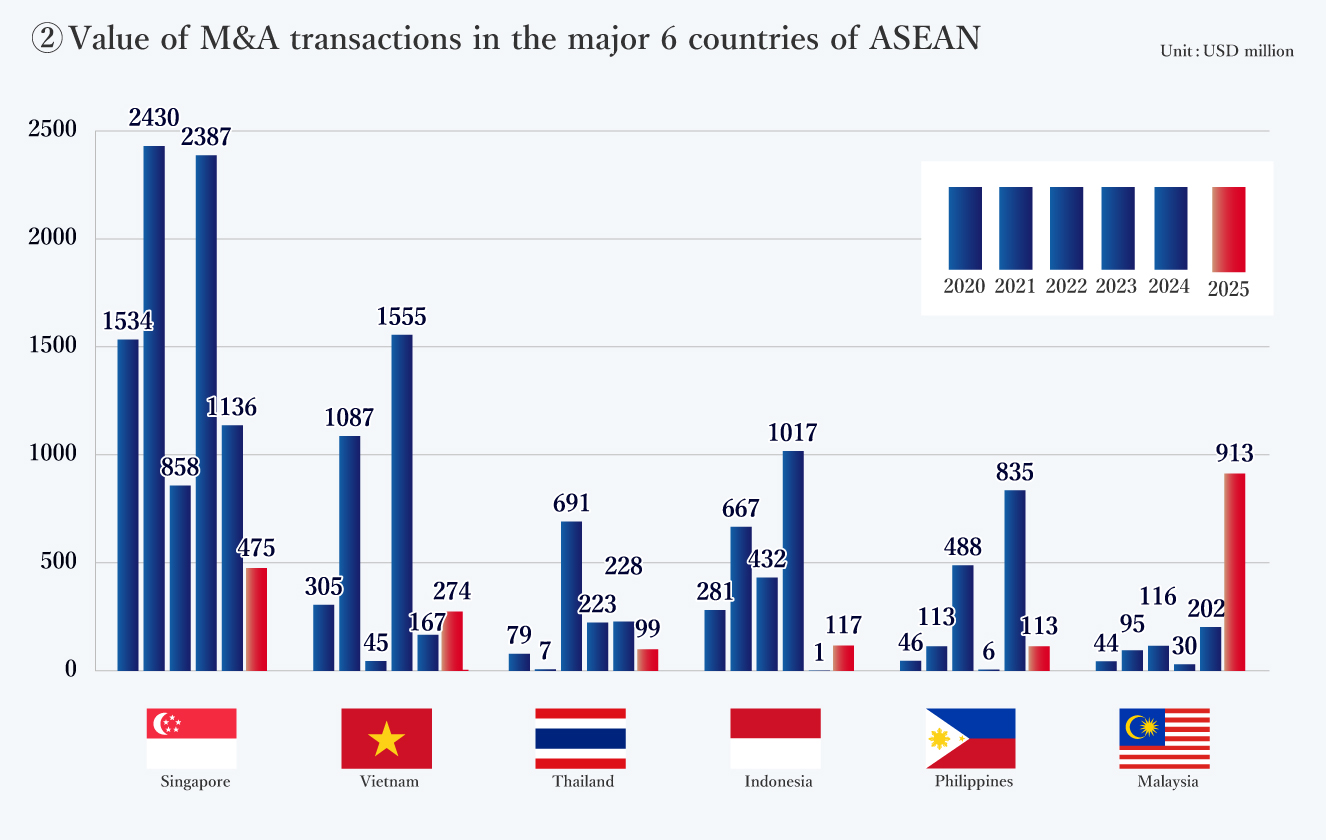

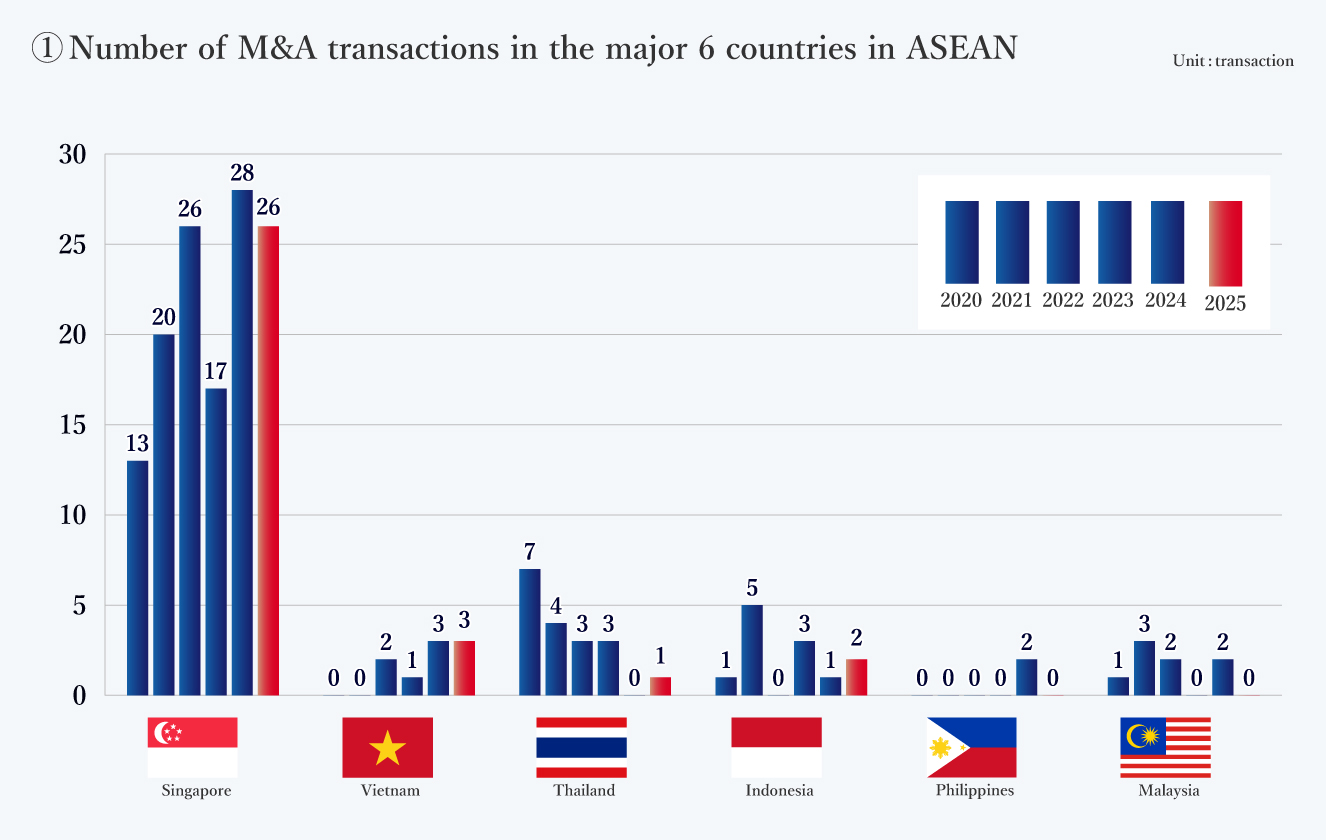

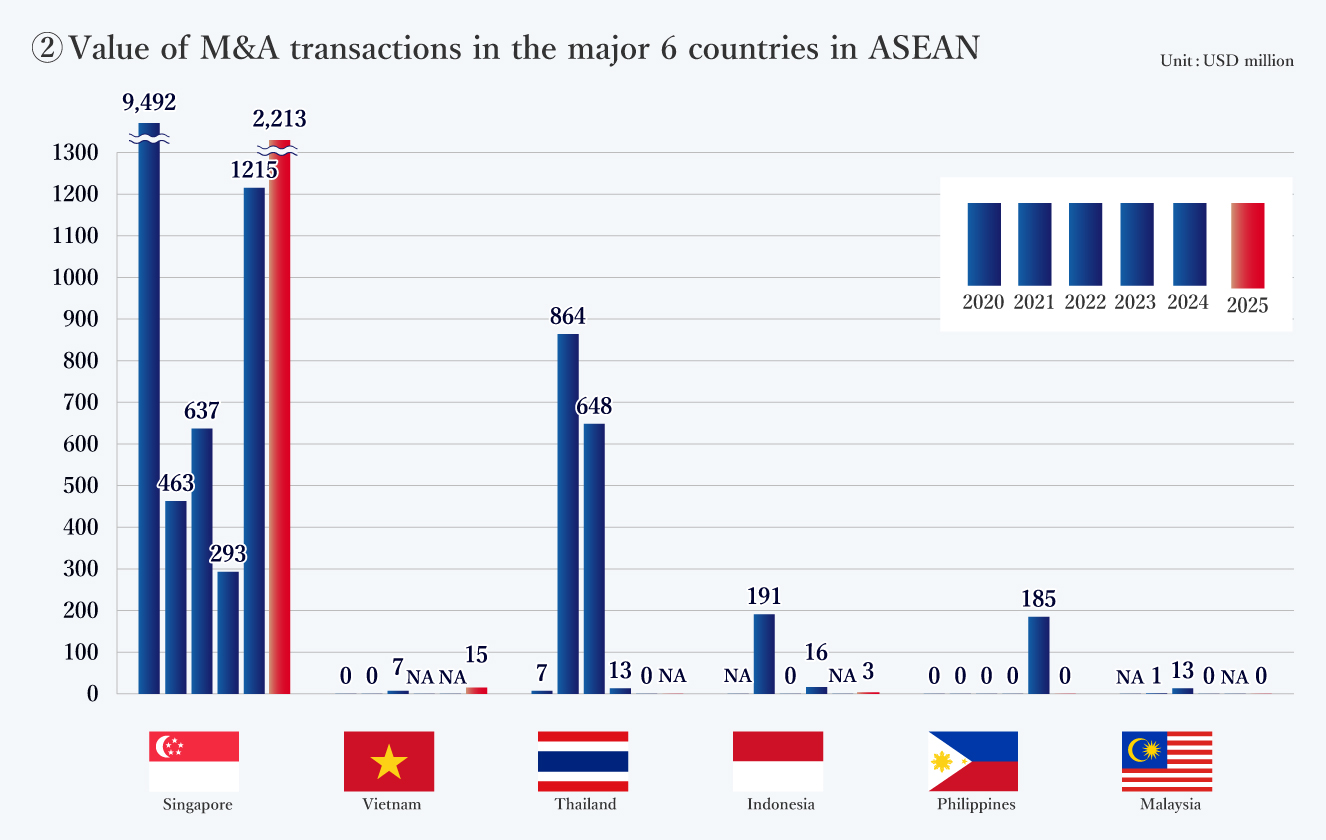

Japan and major 6 ASEAN countries include Singapore, Vietnam, Thailand, Indonesia, the Philippines and Malaysia's number and value of M&A transactions are as follows.

- ◆Source: RECOF DATA Corporation

- ◆Foreign currency rate: JPY 150 / USD(Using the same rate is used for each year, considering the continuity of the data.)

JP

JP Vietnamese

Vietnamese